florida estate tax filing requirements

No Florida estate tax is due for decedents who died on or after January 1 2005. As a result of recent tax law changes only those who die in 2019 with.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Additionally counties are able to levy local taxes on top of the state.

. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The Estate Tax is a tax on your right to transfer property at your death. Estates subject to federal estate tax filing requirements and entitled.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Floridas estate tax is based on the allowable federal credit for state death taxes. All foreign surplus lines insurers are required to file quarterly policy information to FSLSO for policy transactions written during the quarter no later than 90 days after the quarter ends.

Tax-exempt organizations that have unrelated trade or business income for federal income tax purposes are subject to Florida corporate income tax and must file either the Florida. No Florida estate tax is due for decedents who died on or after January 1 2005. If the death occurs on or after January 1 2000 but before January 1 2005 the personal representative must comply with the two requirements listed above and.

Executors administer an estate under a valid will. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

The estate will not have any tax filing or payment obligations to the state of Florida. If they owned property in another state that state might have a. Florida does not have an inheritance tax so Floridas inheritance tax rate.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Deliver goods to Florida customers using your company-owned or leased truck. However if the decedent owed Florida intangibles taxes for any year before the repeal of the intangibles.

Florida estate tax due. 4810 for Form 709 gift tax only. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

If the date of death value of the decedents US-situated assets together with the gift tax specific exemption and the amount of the adjusted taxable gifts exceeds the filing. Florida tax is imposed only on those. Executors duties in Florida include taking control of the decedents.

Floridas general state sales tax rate is 6 with the following exceptions. For more information about business connection nexus or location also called situs please email the. Department of the Treasury.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

The types of taxes a deceased taxpayers estate. Executors must be over 18 and capable of performing the duties.

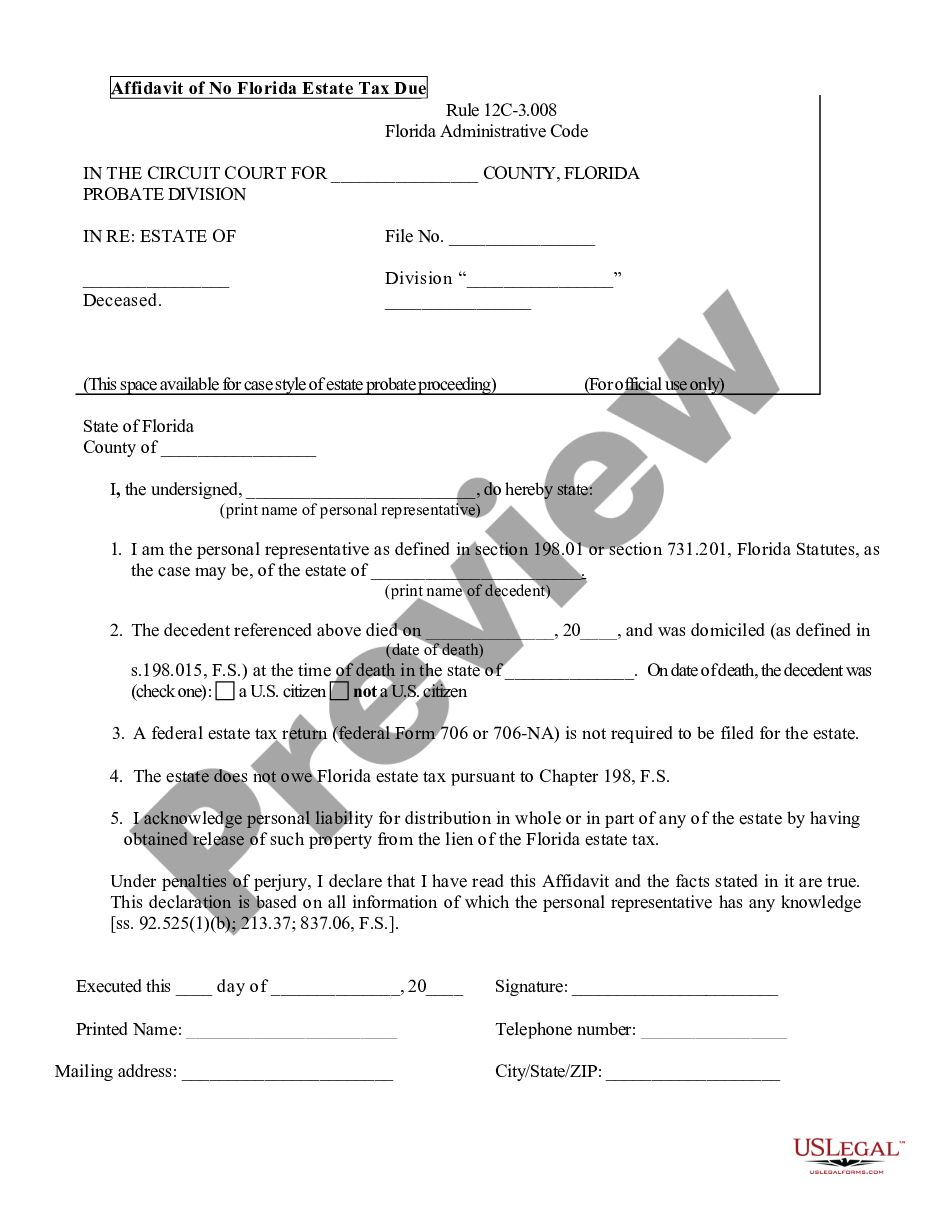

Form Dr 312 Fillable Affidavit Of No Florida Estate Tax Due R 08 13

Form Dr 313 Affidavit Of No Florida Estate Tax Due When Federal Return Is Required R 06 11

Does Florida Have An Estate Tax

Estate Tax Campaign National Committee For Responsive Philanthropy

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

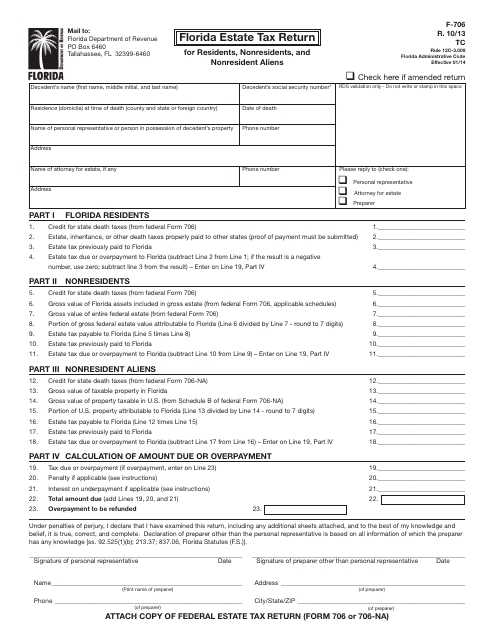

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller

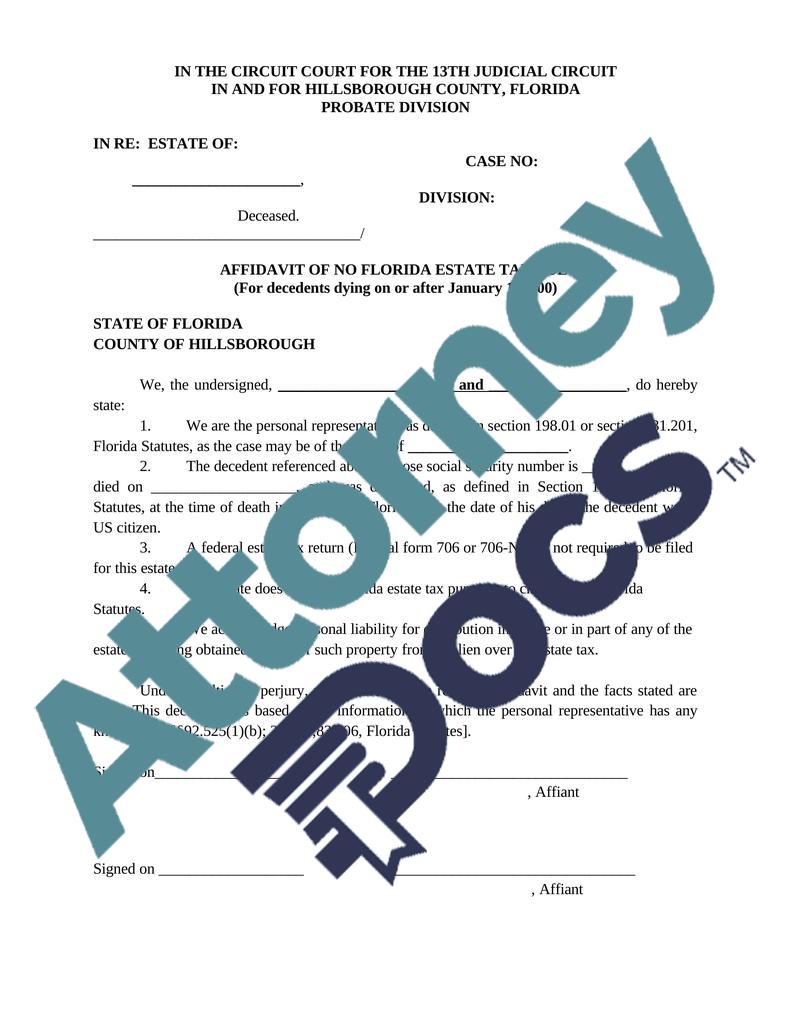

Affidavit Of No Florida Estate Tax Due Attorney Docs The Legal Document Marketplace

Free Florida Small Estate Affidavit Pdf Eforms

Affidavit Of No Florida Estate Tax Due Florida Affidavit Of No Estate Tax Due

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Boca Raton Estate Tax Returns Florida Probate Law Firm

Florida Estate Tax Everything You Need To Know Smartasset

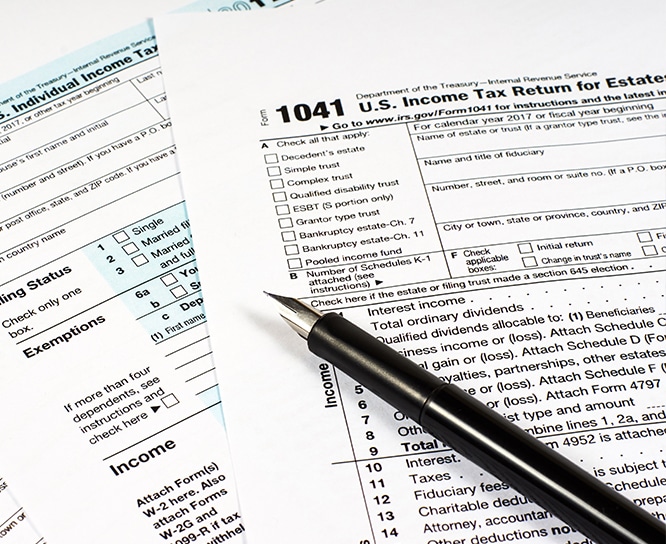

What Tax Returns Must Be Filed By A Florida Probate Estate

Does Florida Have An Inheritance Tax Alper Law

Moved South But Still Taxed Up North

Affidavit Of No Florida Estate Tax Due Florida Affidavit Of No Estate Tax Due

Notice Of Federal Estate Tax Return Due P 3 0950 Pdf Fpdf Doc Docx