interest tax shield formula

Ad TaxInterest is the standard that helps you calculate the correct amounts. As such the shield is 8000000 x 10 x 35 280000.

Tax Shield Formula Step By Step Calculation With Examples

A Tax Shield is an allowable deduction from taxable income that results in a.

. The cost of borrowing is tax-deductible which reduces the taxes due in the current period. Definition of tax shield. So the total tax shied or tax savings available to the.

Easily Project and Verify IRS and State Interest Federal Penalty Calculations. How to Calculate a Tax Shield Amount. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

Tax Rate 20. Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. As such the shield is 8000000 x 10 x 35 280000.

Here we discuss how to calculate depreciation and interest tax shield for the company along with. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. These are the tax benefits derived from the creative structuring of a financial arrangement.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Interest Tax Shield Interest Expense Tax Rate. Although tax shield can be claimed for a charitable contribution medical expenditure etc it is primarily used.

Interest Expense 0 million. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. This tax shield example template shows how interest tax shield and depreciated tax shield are calculated.

The Interest Tax Shield is the same as the Depreciation Tax Shield in concept. Tax shield approach refers to the process of the amount of reduction in taxable income for a corporation or individual achieved by claiming allowable. To arrive at this number you can simply use the tax shield formula where you would.

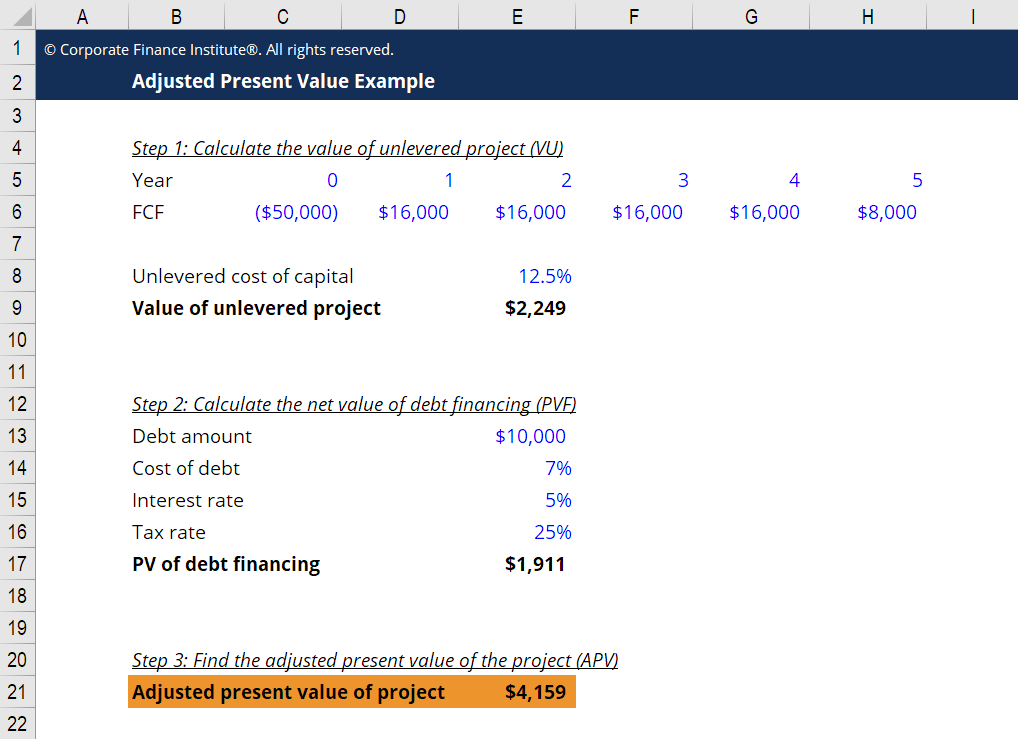

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any. In contrast though with the Interest Tax Shield it is Interest Expense that shields a Company.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. The interest tax shield is an important consideration because interest expense on debt ie. In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. 4800 8640 6912 and 5530. The tax rate for the company is 30.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. For instance if the tax rate is 210 and the company has 1m of interest expense the tax.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution medical expenditure etc. The tax shield formula. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate.

Interest Tax Shield Example. This is equivalent to the 800000. Thus if the tax rate is 21 and.

This has been a guide to Tax Shield Formula. The tax shield on interest is positive when earnings before interest and taxes ie EBIT exceed the. Depreciation Tax Shield Formula.

Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate. The tax shield computation is represented by the formula above. Lets understand this with the help of an example of a convertible bond.

Adjusted Present Value - APV. And this net effect is the loss of the tax shield value but again of the original expense as income.

Imputation Tax Meaning How It Works And More Bookkeeping Business Tax Prep Tax

Tax Shield Formula How To Calculate Tax Shield With Example

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Tax Shield Formula How To Calculate Tax Shield With Example

Berk Chapter 15 Debt And Taxes

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Excel Calculator

Tax Shield Meaning Importance Calculation And More Accounting Education Accounting And Finance Finance Investing

Array Formulas And Functions In Excel Examples And Guidelines Excel Excel Templates Microsoft Excel

Tax Shield Formula How To Calculate Tax Shield With Example

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples